What is the Property Tax Rate in

Malaysia?

How is property tax determined for foreigner buying property in

Malaysia? Surprisingly, both foreigner and local will be imposed the same

property tax rate effective from 1 Jan 2010 as according to the announcement of

latest Budget 2010

Malaysia by

government.

Real Property Gains Tax (RPGT) at a fixed rate of 5% will be

imposed on the gains from the disposal of real property for all categories of

owners. What is Real

Property Gains Tax?

REAL PROPERTY

GAINS TAX ACT 1976 (SCHEDULE 5)

RPGT is a tax levied by the Inland Revenue Board (IRB) on

chargeable gains derived from the disposal of real property. This tax is

provided for in the Real Property Gains Tax Act 1976. The tax is levied on the

gains made from the difference between the disposal price and acquisition

price. Source: Valuation and Property

Services Department, Ministry of Finance Malaysia

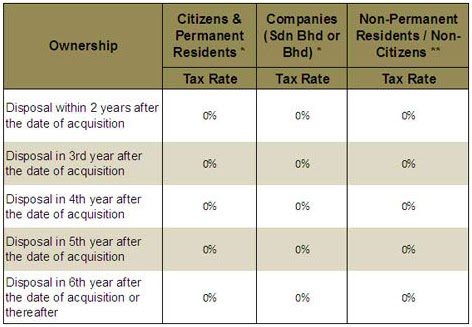

RPGT EXEMPTION –

EFFECTIVE FROM 1 APRIL 2007

With effect from 1 April 2007, RPGT would not be imposed on

gains made from the disposal of real property. The Real Property Gains Tax

Exemption Order was gazette as P.U. (A) 146 on 1 April 2007, which excludes the

application of all the rules of the Real Property Gains Tax Act. Source: Jabatan

Penilaian Dan Perkhidmatan Harta Malaysia

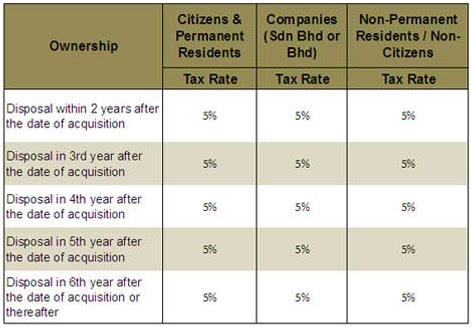

RPGT 5% FLAT RATE

– EFFECTIVE FROM 1 JAN 2010

In the Budget 2010 presentation, the Government proposed that

real property gains tax at a fixed rate of 5% be imposed on the gains from the

disposal of real property effective Jan 1, 2010. The Real Property Gains Tax

(Exemption) Order 2009 will be gazette as soon as possible and is effective Jan

1, 2010. Source:Datuk Seri Ahmad Husni Hanazdlah, Second Finance Minister

of Malaysia

Impact of 5% RPGT on Property Investment in Malaysia

New fixed rate of 5% Real Property Gain Tax (RPGT) has

been proposed in Budget 2010 presentation recently. It will be implemented

start from 1st January 2010. So, what are the impacts of 5% RPGT on property

investment in Malaysia?

FOR HOME BUYER WHO,

Scenario 1: Buying New House from

developer

§ If buying for own stay, you are not really affected as you

may notice the developer and banker still offering attractive packages for new

property

§ If buying for investment purposes, at least you are now

aware about the 5% RPGT and it should be taken into consideration.

Scenario 2: Buying Second Hand house

from sub-sales market

§ As a buyer, you are not affected directly because the RPGT

will be imposed only on the gains from the disposal of the property for seller.

§ However, it has a minor impact on sub-sales market.

Sellers start to hold back their selling plan due to the changes and

uncertainty. Both seller and buyer are now in the ‘wait-and-see’ mode, hope for

good news from Government of Malaysia.

FOR HOME SELLER WHO,

Scenario 3: Selling their house

bought from developer or sub-sales market within short period (5 years, 3 years

or earlier)

§ I think it is fair for Government to impose tax on those

Investors who are making money from their property investment at a reasonable

rate.

Scenario 4: Selling their house which

has been bought/built for own stay many years ago (20 years, 30 years or even

longer time)

§ RPGT was introduced mainly to prevent the property

investor over speculates the market and cause bubble. Therefore, it is not fair

to impose RPGT on home seller who bought their house thirty years ago. Some of

them bought for own stay, not for investment.

§ Generally, most of the property experts believe the

sub-sales market will be slow down for this coming few months but for short

term only.

Individuals will open doorways in your house – loos, closets, bedrooms. It’s vital to verify the home would not appear cluttered. Do not feel compelled to cram everything in storage to the purpose it might avalanche. Get the household to pitch in and straighten sheets and shelves, and vacuum and sweep the floors.

ReplyDeleteAl Reef Villas Abu Dhabi

I appreciate their mission to educate everyone. cost segregation

ReplyDeleteCost segregation improves financial efficiency. wotc tax credit

ReplyDelete